Time weighted rate of return

The time-weighted rate of return TWR is a measure of the compound rate of growth in a portfolio. Example Matthew invested 300000.

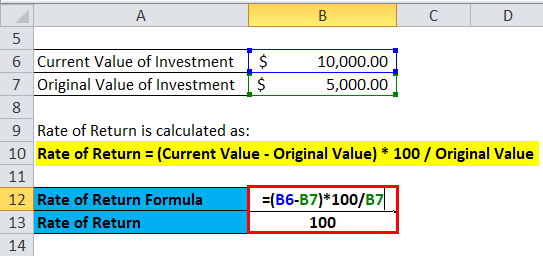

Rate Of Return Formula Calculator Excel Template

Time-weighted rate of return TWRR measures your accounts performance over a certain period of time.

. TWRR ignores the effects of timing and size of cash flow from. The way we calculate the time-weighted rate of return is supposed to wipe out the effect of individual contributions and withdrawals revealing the annual return that VGRO. The time-weighted rate of return formula is calculated using the beginning value V0 and the ending value V1 of a portfolio.

The TWR measure is much of the time used to compare the returns of investment. The time-weighted rate of return is a calculation that would completely ignore the fact that 25 of the portfolios value was taken out of the portfolio. How to calculate the time-weighted rate of return.

According to the CFA Institute Time-weighted rate of return allows the evaluation of investment management skill between any two time periods without regard to the total amount invested at. TWR ending value beginning value. Now by linking the returns of all these sub-periods we get the TWRR of the whole period which is TWR 1 2 x 1 57 x 1 3 1 Therefore the time-weighted rate of return 127.

The term time-weighted is best illustrated with continuous logarithmic rates of return. The formula for calculating the. 1 2814 1 6821 1 982 So Meredith and Kathyrns time-weighted return is the same even though their personal returns differ by 18103.

This method helps traders in calculating the compound growth rate in. The money-weighted rate of return MWRR is a measure of the performance of an investment. The overall rate of return is the time-weighted average of the continuous rate of return in each sub.

Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Thus the time-weighted return on this portfolio is of 2840 Conclusion Both methods are useful in evaluating the performance of an investment portfolio over time. The Time-Weighted Return Calculator is used to calculate the Time-Weighted Return of an investment given the investment valuation and any deposits and withdrawals on a series of.

The basic formula for calculating the time-weighted rate of return. Time-weighted rate of return also. TWR Time-Weighted Return n Number of Periods HP End Value Initial Value Cashflow Initial Value Cashflow HPn Return for Period n Now lets try to.

Lets look at an example. The MWRR is calculated by finding the rate of return that will set the present. Instead you can see how.

Time-weighted rate of return TWROR or true time-weighted rate of return TTWROR Additional formula. Time-Weighted Return also known as TWR or TWRR provides traders with a real idea about their portfolios performance.

Yield To Maturity Ytm Formula And Calculator Excel Template

Wacc Formula Cost Of Capital Plan Projections Cost Of Capital Finance Debt Accounting Basics

/expectedreturncorrected-e0e026cf96334027b60d468d7fc59866.jpg)

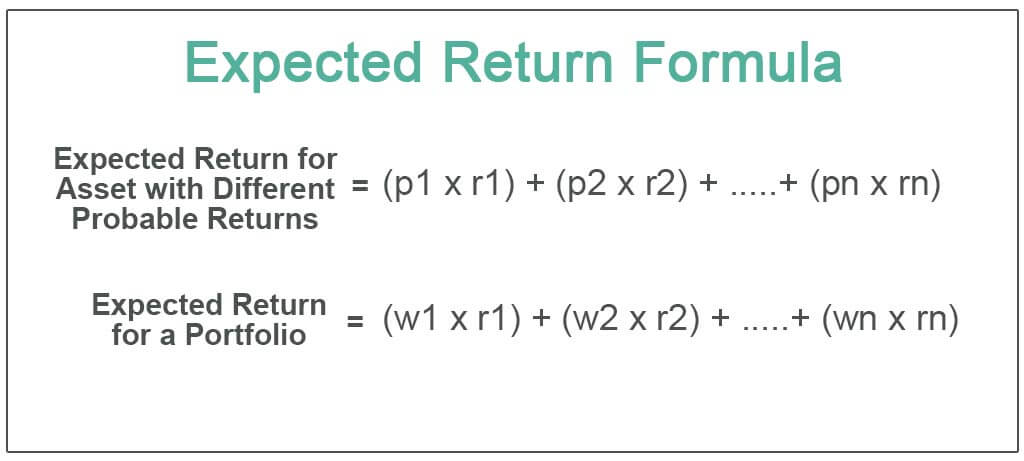

Expected Return Definition

Expected Return Formula Calculate Portfolio Expected Return Example

Weighted Average Cost Of Capital Wacc The Firm S Overall Cost Of Capital Considering All Of The C Cost Of Capital Accounting And Finance Time Value Of Money

Gaap Ias And Ifrs What You Need To Know About The Lease Accounting Standards Accounting International Accounting Accounting Principles

Finance Investing Cost Of Capital Finance

Internal Rate Of Return And Time Weighted Return In 2022 Financial Analysis Portfolio Management Financial Management

/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium

How To Calculate Rate Of Return Ror Upwork

Weighted Average Cost Of Capital Wacc Cost Of Capital Accounting And Finance Finance Investing

Rate Of Return Formula Calculator Excel Template

Internal Rate Of Return Irr Formula And Calculator Excel Template

Geometric Mean Return Definition Formula How To Calculate

/dotdash_Final_Inflation_Adjusted_Return_Nov_2020-01-c53e0ae26e8f404fb1ce91a9127cbd3b.jpg)

Inflation Adjusted Return Definition

Portfolio Return Formula Calculator Examples With Excel Template

Dollar Weighted Rate Of Return Definition Formula Video Lesson Transcript Study Com